By Eleanor Gee

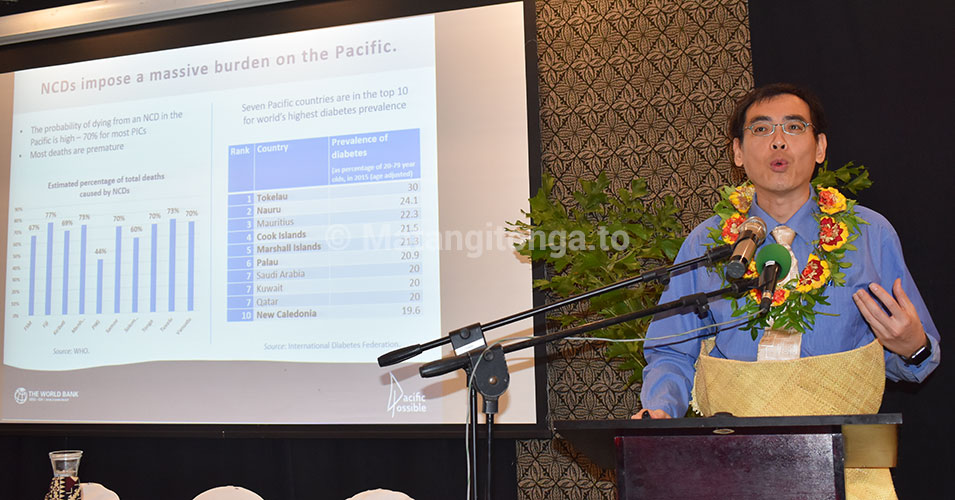

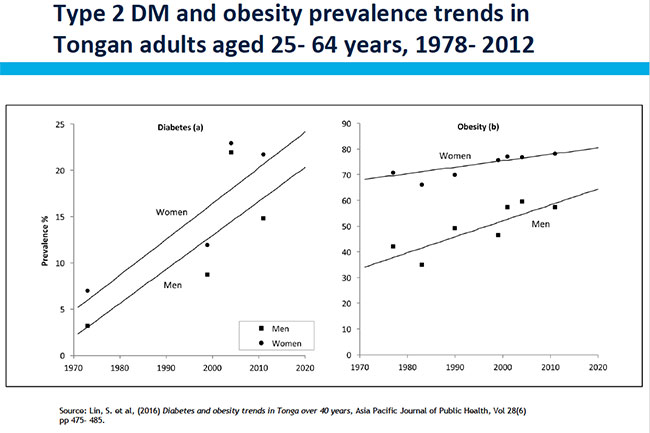

Tonga can better fight its NCD crisis by removing tax on chicken meat and putting new tax on local tobacco, while ensuring stronger price control, monitoring, and enforcement, a new World Bank study recommends.

The World Bank study was presented in Nuku'alofa on September 3, at a seminar on improving Tonga’s taxation policies in response to the Non-Communicable Disease (NCD) crisis.

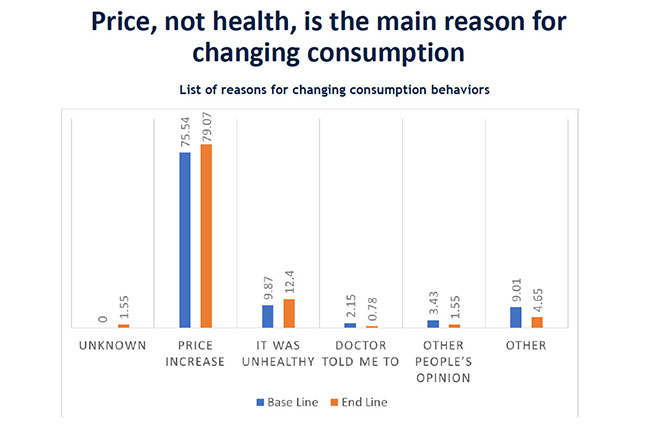

The study, the first of its kind in the Pacific, looked at a previous increase in tax on imported tobacco, unhealthy foods and beverages, and alcohol, and the impact it had on consumers since being implemented in 2016. The study found that price had affected consumer behavior and that the consumption of products such as lamb flaps, turkey tails, ice cream, soda drinks, and alcohol had decreasedin Tonga, while other price increases on tobacco and chicken had not affected consumption.

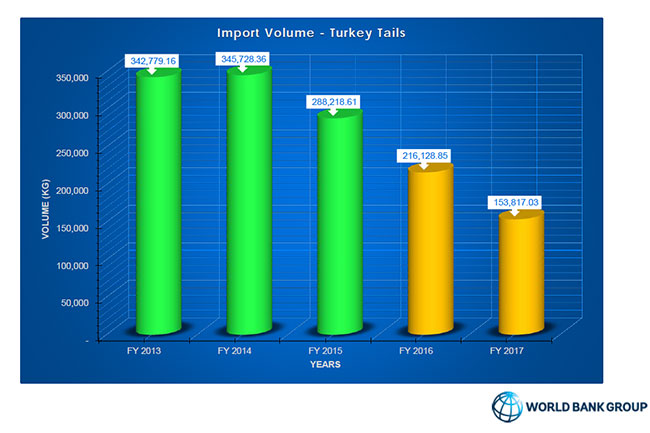

Lamb flaps imports to Tonga fell by over 40 percent from over 1.475 million kilograms in 2016 to 847,395kg in 2017. Turkey tails imports fell by around 29 percent from 216,128kg in 2016 to 153,817kg in 2017.

In 2017, chicken was found to be the cheapest meat on the market in Tonga, despite a price increase, making it the most imported and consumed meat. The study revealed that although chicken meat comes under the NCD tax, there is no global evidence that it is unhealthy. In light of this, the World Bank recommended that chicken meat should not be taxed.

Cooking

World Bank’s Dr Sutayut Osornprasop, who led the study, said that chicken meat is generally not unhealthy.

“I think the key is how you cook it in a healthy way. Because if you deep fry chicken, then it’s not that healthy anymore. But if you steam, stir fry or boil chicken, I think it is a very healthy food and an important source of nutrition.”

Tobacco also showed no change in consumption but price increases in manufactured cigarettes saw people move to using tapaka Tonga, which is a much cheaper alternative and not taxed. In 2017, manufactured cigarette prices increased from $8.50 to $12 to $14, while tapaka Tonga increased from $5 to $6. Currently, manufactured cigarettes are priced between $16 to $20.

“We hope that government will consider imposing a tax on commercialized tapaka Tonga," said Dr Osornprasop. "Once it is commercialized then it should be taxed. Otherwise you have preferential treatment for the same products, which is not fair. And because it’s so cheap, a lot of people have access to it including the young people. And this is very worrying.”

To encourage healthier eating, products such as apples and oranges are tax exempt and retail prices are set by the Tonga Competent Authority as health controlled products.

Price violations on fruit

The study found that some retailers did not pass on the tax exemption to consumers and were selling by bags instead of weight. The set price for apples is $3.89 per kg, but retailers sold them at a higher price of $5 for 950 grams. Oranges were also found to be sold at $5 for 600 grams, above the set price of $5.70 per kg.

Dr Osornprasop said “If the retailers sell over the maximum price, it means that they violate the rules and they are supposed to get a warning. I believe they may have taken action on certain shops but it seems other shops are still doing it. There is an issue on monitoring and enforcement.”

“Usually if sold by weight, it will be the consumers who help check and balance, because they would complain if it didn’t meet the right weight. When it is sold in bags, consumers don’t have the power to negotiate because they don’t know how much it weighs.”

Consumer unawareness

The study found that tax exemption on healthy products did not work because there was no change in price, or consumption behavior, and only 12% of the population were aware of the tax exemption on imported fruit.

Other products which have been tax exempt since July 2016 include, water, eggs, milk powder, sausages, meat (ham), molluscs, Milo, aquatic invertebrates, crustaceans, caviar, natural honey, mussels, and yoghurt.

Other recommendations from the study included:

- applying the same level of excise tax on unhealthy imported goods and locally manufactured goods, such as tapaka Tonga and manufactured cigarettes;

- ensure taxation policy is implemented and enforced on goods such as locally manufactured noodles where no tax has yet been collected;

- ensure a more consistent policy approach for other unhealthy products such as salted beef and corned beef, which had increased in consumption but are not subject to NCD tax;

- engage politicians, social and community leaders, and church leaders to support social and behavior change.

- NCDs place significant pressure on the government’s health expenditure, therefore other sectors such as agriculture, health, and education, should be involved as tax policy alone cannot address NCD burdens.

The study was conducted on Tongatapu and Vava’u and started in February 2017.

Comments

If we are serious about

If we are serious about reducing NCD through increasing taxes we should ask how is government spending the said tax. To make an immediate dent in the NCD cycle an outright ban on fake food and drink, mutton flaps, turkey tails etc. would have a serious impact. Let's stop going round in circles ban the stuff. Malo.