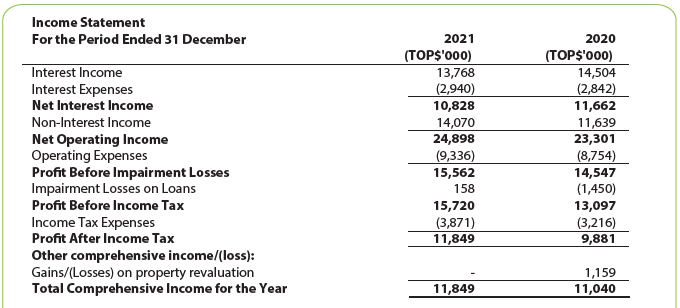

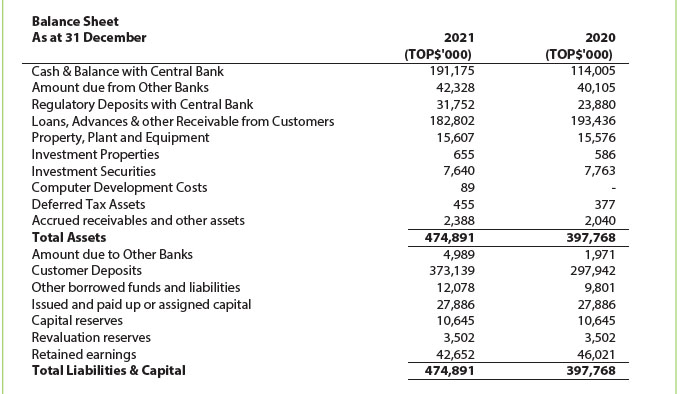

Bank of South Pacific Tonga Limited (BSP Tonga) today, 3 March 2022, announced a Net Profit After Tax of T$11.85 million for the financial year ending 31 December 2021. The result was driven by the release of Covid-19 provisions, good foreign exchange revenue, and strong transaction volumes.

BSP Tonga Country Head, Mrs Wolfgramm-Haapai said: “The Net Profit after tax of T$11.85 million was 20% above the 2020 financial result. These were delivered from increases in non-interest income (particularly volume growth in foreign exchange and MoneyGram, remitted from the Tongan diaspora overseas), prudent management of expenses and the release of lending provisions undertaken across 2020 to support customers on COVID 19 Lending Relief packages.” She noted that the release of debt provisions was as a result of customers returning to full repayments and a favourable macro-economic outlook.

Across 2021, BSP Tonga Limited’s customer base grew 7.4% with over 37,400 selecting BSP as their bank of choice. The bank maintained its footprint across Tongatapu, Vava’u, Ha’apai and ‘Eua, serving over two million customers across its various channels - 15 ATMs, 34 Agents, over 250 Eftpos devices throughout the year.

BSP Tonga’s customers were supported with fee reductions across various transaction products, reductions in interest rates (particularly unsecured personal loans at 13% p.a.) and remaining the lowest home loan rate provider in market at 7.15% p.a. The Bank’s COVID 19 Relief packages also remained on offer to those impacted customers supported – and these will remain available across 2022.

Community sponsorships throughout 2021 saw the Bank renovation of the Anglican Church giving small to medium businesses a secure place to sell. Partnerships with Rotary Club of Nuku’alofa saw the repairs made to equipment at the Fa’onelua Children’s Park and donations included school desks and water tanks in the outer islands including the Ha’ano Primary School amongst others.

Following the recent volcanic eruption and tsunami – BSP donated TOP $50,000 to the Government of Tonga to support the reconstruction efforts of communities displaced particularly the island of Mango. A Tsunami Loan Relief Package is also available to assist with damages and cleaning as well as a new Tsunami Personal Loan at a discounted rate of 10%pa.

Her announcement comes after the BSP Chairman Sir Kostas Constantinou released the BSP Group Full Year Results – 31 December, 2021, last week, noting a consolidated operating profit after tax of K1.075 billion. Group CEO Robin Fleming and the board congratulated BSP Tonga on the results for 2021.

Principal Activities

Bank of South Pacific Tonga Limited (“BSP”) is a 100% owned subsidiary of BSP Financial Group Limited which is a leading Papua New Guinea based bank with a wide network extending across the Pacific and Asian regions, including Fiji, Vanuatu, Cook Islands, Solomon Islands, Samoa, Tonga, Cambodia and Laos. The principal activities of the bank are the provision of retail, commercial and general banking services.

Directors

Directors of “BSP” as at 31 December 2021 are:

Sir Kostas G. Constantinou, OBE; Mr. Robin Fleming, CSM; Mr. ‘Alifeleti ‘Atiola; Ms. Elizabeth Sullivan; Ms. MWolfgrammHaapai [at] bsp [dot] com [dot] pg (Marcellina Wolfgramm Ha‘apai.)

--

About BSP

Bank South Pacific (BSP) is an iconic and unique bank in Papua New Guinea and the Pacific, recognised for its strong commitment to the region. We are a major commercial banking and finance group with assets of approximately PGKK23.050 billion.

BSP has the largest branch network in Papua New Guinea, Cook Islands, Fiji, Samoa, Solomon Islands, Tonga and Vanuatu with sub branches and agents in rural locations. The BSP Group employs 4,000+ people across the Pacific and proudly supports the communities that we operate in, through Community Projects, Sports, Education, Health, Culture and Financial Literacy. Our branch network is complemented by electronic banking networks that can meet the banking needs of all customers wherever we operate.

--