By Finau Fonua

Over 300 businesses and 4,000 employees are yet to be registered with the National Retirement Benefits Fund (NRBF), according to the NRBF Annual Report for 2014 released last week, for its second year of operation.

The National Retirement Benefits Fund formed under the National Retirement Benefits Scheme Act 2010, is a welfare scheme that provides pensions to retired workers. The pension age accorded by law is 60 years.

To finance the retirement fund, the Act requires compulsory contributions from all employees and employers in Tonga. The compulsory contributions are drawn from 5% of wages from the employees and matched with 5% of wages from the employer. Members are all provided with individual accounts into which the compulsory contributions are recorded.

According to the Act, benefits are provided to members who have either reached the pension age of 60 years, or who are permanently disabled before pension age or who have died before pension age (allocated to beneficiaries).

Penalties for breaching the Act are severe. According to the Act, anyone who fails to pay their contributions “commits an offence and shall be liable upon conviction to a fine not exceeding $2,500”.

Any person who obstructs officers of the organisation in the exercise of their duties “commits an offence and shall be liable upon conviction to a fine not exceeding $10,000 or to imprisonment for a term not exceeding three years or both”.

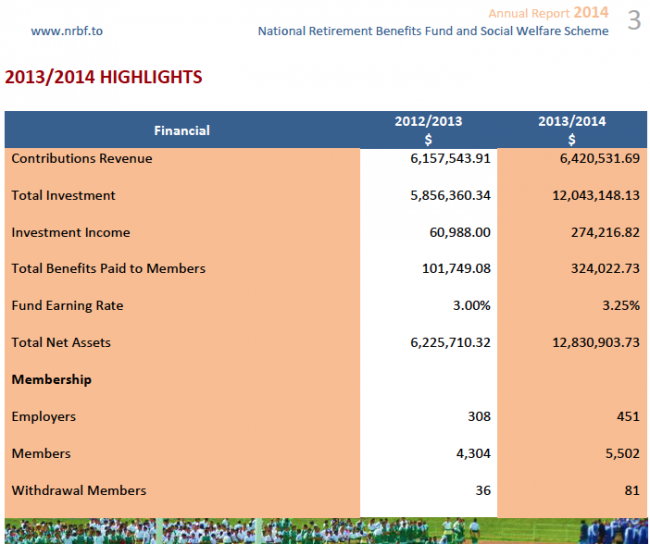

A total of 5502 members were registered and contributing to the Fund at 30 June 2014, an increase of 27.83% from the previous year. However, "according to the ongoing reconciliation exercises with the Ministry of Commerce, Tourism and Labour and the Ministry of Revenue more than 4000 employees are yet to be registered,” the report stated.

A total of 451 employers were registered but the reconciliation "revealed that more than 300 businesses are yet to be registered."

According to the Annual Report for 2014, the total members fund and net assets available for benefits was $12,830,903. Administration expenses were $663,875, while board administration expenses were $103,524. Investment income was $274,216 for the period.

The board members are Rev. Dr Tevita Havea (Chair and employees rep.); Lata'ifaingata'a Tangimana (employees rep.), Peseti Ma'afu (employers rep), 'Aisea Taumoepeau (Minister of Finance's appointee) and Dr S. Leimoni Taufu'i (CEO and Secretary).

Comments

Request for enlightenment "

Request for enlightenment " The National Retirement Benefits Fund formed under the National Retirement Benefits Scheme Act 2010, is a welfare scheme that provides pensions to retired workers." Why is it that "the pension age accorded by law is 60 years" but there is no age restriction, nor physical and mental health checks required of candidates for elections. Some of those elected (Parliamentarians, Cabinet Ministers, Board members etc) end up being entrusted with the responsibility of running our beloved country?